Introducing the Vulnerable Customers Report

In this new report for 2022, Boring Money assesses vulnerable customers for the investment industry. As part of the final guidance on Consumer Duty, published in July 2022 FG22/5, the FCA places particular emphasis on the “firms paying attention to the needs of customers with characteristics of vulnerability” under all 4 objectives.

Potentially vulnerable customers are much more common than might be assumed. If we include low confidence as an aspect of vulnerability, alongside emotional, mental and physical criteria, then as many as 34% of investors could be classified as vulnerable, according to FCA criteria.

Research sources and methodology

The data was collected in Q3 2022, from a nationally representative survey of 4,500 UK adults. We have segmented the data to focus on various different cohorts, filtering down into a deeper dive into vulnerable customers specifically.

This report will provide

The aim of the report is to arm platforms, asset managers and advisers with the data they need to respond to consumer duty, with regards to considerations around vulnerable customers. The report will help you understand the number of vulnerable customers in your own customer base and how to respond to their needs. The report will:

Key facts about vulnerable customers

The largest group is those investors who self-identify as low in confidence

Mental health is the next contributing factor, with 9% of investors citing this as a reason they would seek additional support

And financial vulnerability is next most cited aspect of vulnerability

1 in 4 vulnerable customers is younger than 34, but we see vulnerability start to rise again beyond age 65, particularly with women

Sneak peak of our findings

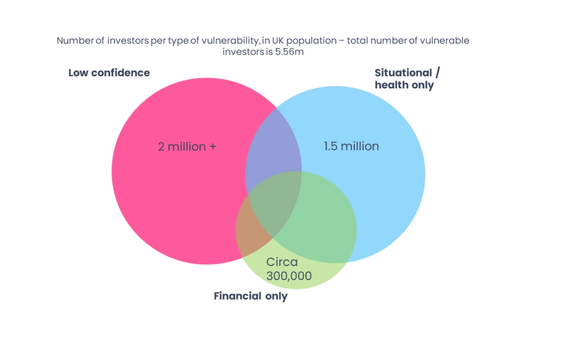

There is an element of crossover between confidence as a source of vulnerability, and health and situational vulnerability

Based on a survey of more than 4,000 nationally representative UK adults we have estimated the number of vulnerable customers, both by the source of their vulnerability. We have also been able to see how the different types of vulnerability interact and overlap with each other.

1 in 3 vulnerable customers holds > £50k in assets in comparison to 1 in 2 non vulnerable customers

We have analysed the relationship between age, assets and vulnerability amongst customers.

Vulnerable customers are more likely to be single

Our data has illustrated the link between investors’ personal relationships and their potential vulnerability. By understanding which customers are more likely to be vulnerable, brands can better target support and communications to meet their needs.

Get the full report

Please talk to dan@boringmoney.co.uk to reserve your copy or ask for a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.