Pensions Report 2022

Introducing the report

Welcome to Boring Money’s 2022 consumer report on pensions.

The aim of this report is to provide a detailed look at consumer attitudes towards pensions, product ownership, and explore the appetite for pension engagement and approaches to pension pot consolidation. Plans for retirement are also analysed and compared against the behaviour of those already retired.

In light of the FCA’s new Consumer Duty rules, the report also has a dedicated section on vulnerable consumers in the accumulation stage and examines how their behaviour compares to the wider population.

This report will provide:

The report will provide pension providers, DIY platforms and financial advisers with a clear insight into consumer attitudes towards pensions and will help, in particular, understand how the needs of the vulnerable differ from the mainstream.

Research sources and methodology:

This report is based on a nationally-representative, online survey of 4,654 UK adults aged 18+ conducted in July 2022.

Pension accumulators / non-retired pension holders: 2,628 UK adults aged 18+, who currently hold a workplace or personal pension / SIPP and are not yet retired.

Vulnerable customers: 1,290 non-retired individuals that selected currently hold a workplace or personal pension / SIPP and stated they would need extra support from an investment company due to the following reasons: mental health difficulties, emotional vulnerability, financial vulnerability, physical disabilities, neurodiversity or learning difficulties or by stating extremely low confidence in selecting a pension.

Key chapters in the report include:

Sizing total pension holdings

Understanding the appetite for consolidation

Pension account management and digital access

Pension investment management

Attitudes towards retirement planning

Understanding the needs of vulnerable customers

Meet our personas

Sneak peak of our findings:

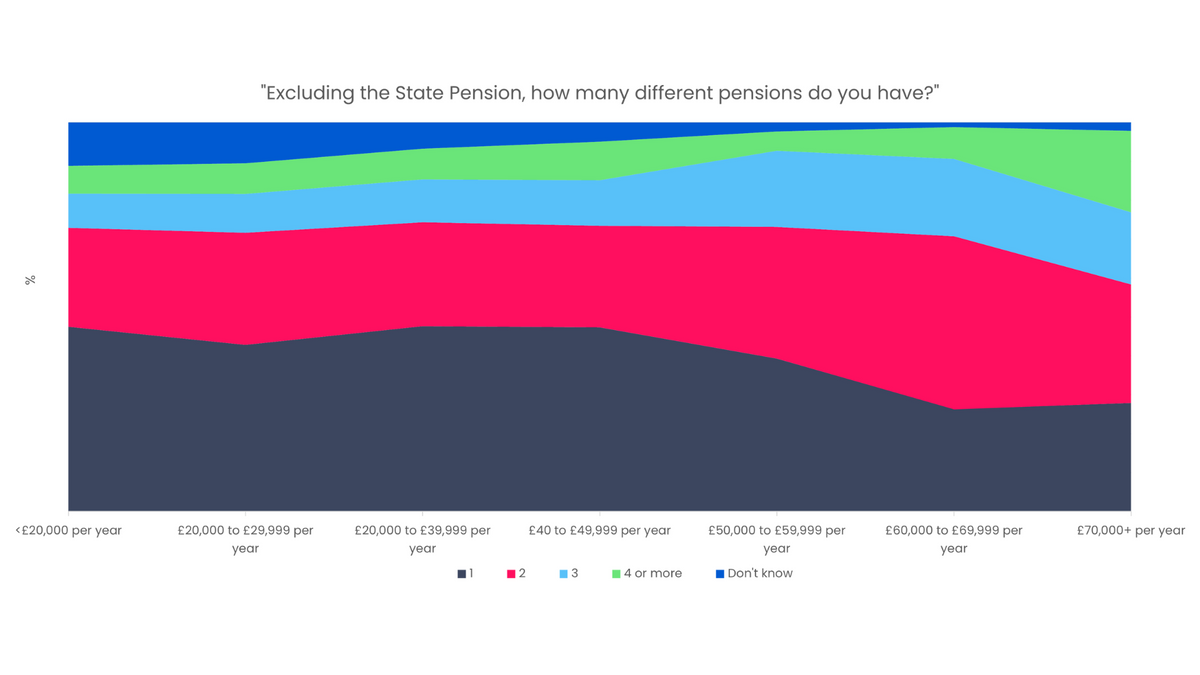

Almost half of accumulators have multiple pensions – buy now to find out what that could mean for the market size of pension consolidation in people and £

Continue reading

Subscribe to unveil the page content! Enter your email address below.