Pensions Report 2024

The Pensions Report 2024 provides a detailed look at pension ownership and explores consumer sentiment, behaviours and needs with regards to pensions in the UK. The report will focus on understanding the customer journey for pension holders at different life-stages, supporting retail firms to identify the most effective messaging to attract pension holders across the consumer spectrum.

Download the Table of Contents

Key insights

SIPP popularity

Pensions are the most popular savings and investment products in the UK. 3 in 4 non-retired UK adults aged 18+ report having at least one pension of some sort

Female SIPP ownership

Just 1 in 5 females earning £75k+ have a SIPP

Gender investment gap

Women earning £75k take out SIPPs at two-thirds the rate of men in the same salary band

Pension consolidation

8% of non-retired pension holders consolidated some/all of their pensions over the last year

DB pension status

There is a shift from “Retirement of the past” to “Retirement of the future” with a transition to more DC and mixed workplace schemes. 42% of those recently retired, aged 65-75, strictly have DB pensions compared to 21% of future retirees aged 45-55

Provider switching

Lack of accessibility of information e.g. communication / access being entirely paper based, is one of the key reasons that people switch pension providers

Pension engagement

Workplace pension holders demonstrate the lowest levels of engagement with their pensions, contrary to personal pension holders who exhibit the highest

Understanding pensions

There is still a large knowledge gap when it comes to pensions. 63% of DB pension holders say they find pension confusing

Who's it for?

Platforms

Banks

Life Companies

Asset Managers

Firms that are selling - Consolidation, SIPPs Pensions Advice / Guidance Propositions.

Key chapters will include:

Pension ownership

• Sizing pension ownership in the UK

• Pension ownership by age and assets

• The changing landscape - DB to DC

Decision making journey

• The report will look at the following across different 'life-stages'

• Common pension actions e.g. consolidation, switching, taking advice - drivers of action, behaviour and choice

• Pension attitudes and behaviours

• Pension management and activity

• Attitudes to pensions

• Workplace pension vs SIPP behaviours

Pension Consolidation

• Multiple pension ownership

• Sizing demand for consolidation

• Identifying targets for consolidation

• Size of consolidation opportunity by assets

Industry Disrupters

• What brands are disrupting the pensions market / ones to watch

• Brands poised for success

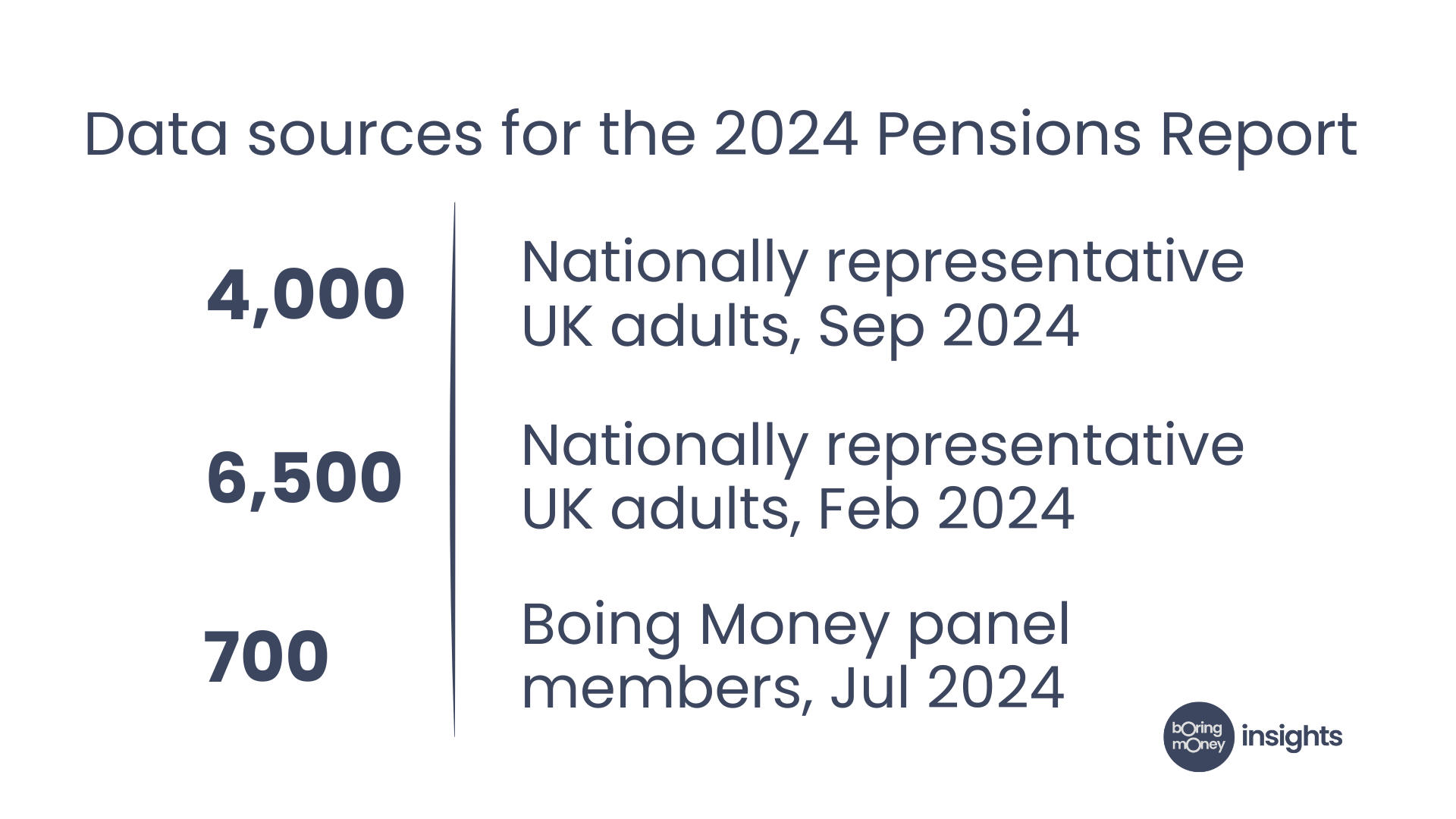

Data sources for the 2024 Pensions Report

Get in touch with us to buy the report

Please contact dan@boringmoney.co.uk and rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.