Online Investing Report 2024

In Out, In Out, Shake it all about

The report is the must-have research publication for any provider looking to set up or currently running a direct-to-consumer investment or pension business in the UK. This year we track over 35 providers in the market, along with new entrants, some departures and a lot of change on the proposition front.

Out 5th March 2024

Some snippets to whet your appetite…

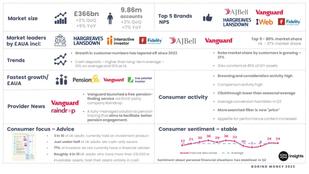

Market size and growth

There was £392 billion in the DIY investment market as at Q4 2023 - a growth of 14% over the year.

There has been a 56% growth in customer accounts since 2020.

There were over 10.2 million accounts in the UK as at Q4 2023.

Platform players

The top 5 platforms retain a powerful market share of 72%. However, Hargreaves Lansdown’s market share has fallen to 36%.

In terms of customer growth, robos continued to perform best, growing market share by customer accounts to 22%.

Vanguard’s market share by £ has risen 10x since 2019.

Meet the investors

Over 3 in 10 Brits are investors.

Nearly 6 in 10 of all investors are men and the average age is 53.

The Gender Investment Gap increased in 2023.

One-third of investors display at least one characteristic of vulnerability.

Beginner investor

7% of investors have less than 12 months’ experience – a substantial proportion of investors have less than 5 years’ experience.

The average investor has been investing for a little over 10 years, so has not experienced a prolonged crash or recession.

Desktop vs mobile

Over-55s strongly prefer people over tech-enabled service, and this age bracket also prefers desktop over mobile.

A significant majority of those who have engaged with their investments over the last 12 months have done so on mobile.

However, mobile engagement has plateaued after years of growth.

Fees and charges

Average platform fees for an ISA have fallen to their lowest ever average.

Average platform fees for a SIPP are now under 0.3% for a £100,000 pension.

Key chapters will include:

Market size

£AUA, customers, market share, growth and more

Consumer research

From a survey of 6,486 nationally representative adults, with segmentation and analysis to pinpoint your target customer

Pricing

Trends, changes and comparative heatmaps

Proposition analysis

Detailed testing and a behind the scenes look at excellence and innovation

Consumer Duty

An analysis on vulnerable customers, risk appetite and consumer understanding

Trends and forecasts

Vital for business planning, we forecast growth and developments in the sector

Get in touch with us to buy the report

Please contact dan@boringmoney.co.uk and rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.