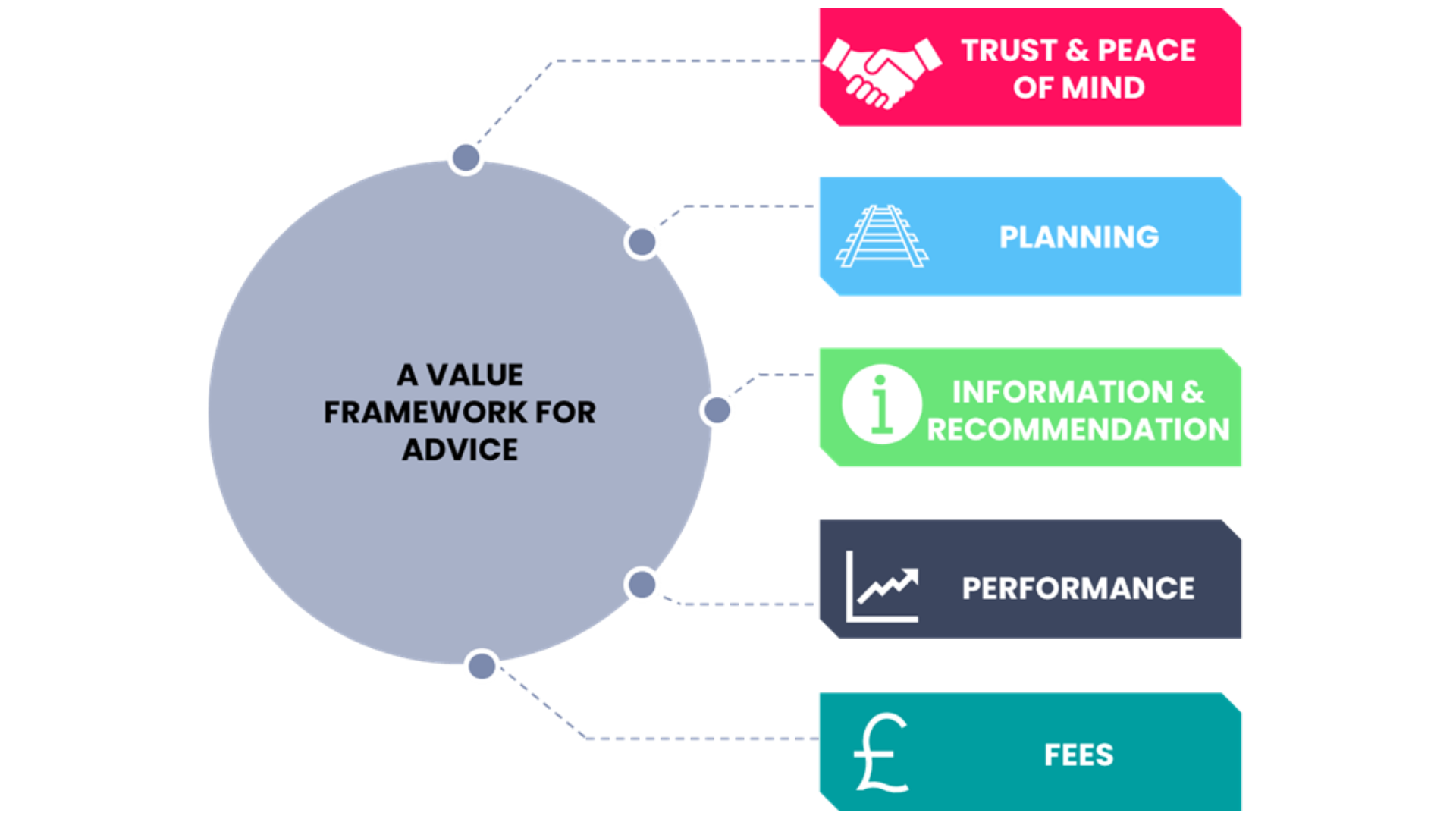

A Framework for Measuring Value for Advice Firms

The FCA’s Consumer Duty requires regulated financial providers to evidence that they are providing good outcomes for the end customer.

This report introduces a framework that can be used as a tool by advice firms to measure and benchmark the outcomes they are providing for their clients.

Report outline

Who’s it for?

Advice firms & advice platforms

What will it give you?

A tool to measure whether you are providing good outcomes for your end-clients

Provides evidence to the FCA that your firm is taking steps to understand what advice clients value, and thought about how your firm is going to assess services provided against Consumer Duty principles

Independent stamp of approval from a third-party provider

Who we spoke to?

Depth interviews with 15 advised investors

Survey of 1,000 advised investors

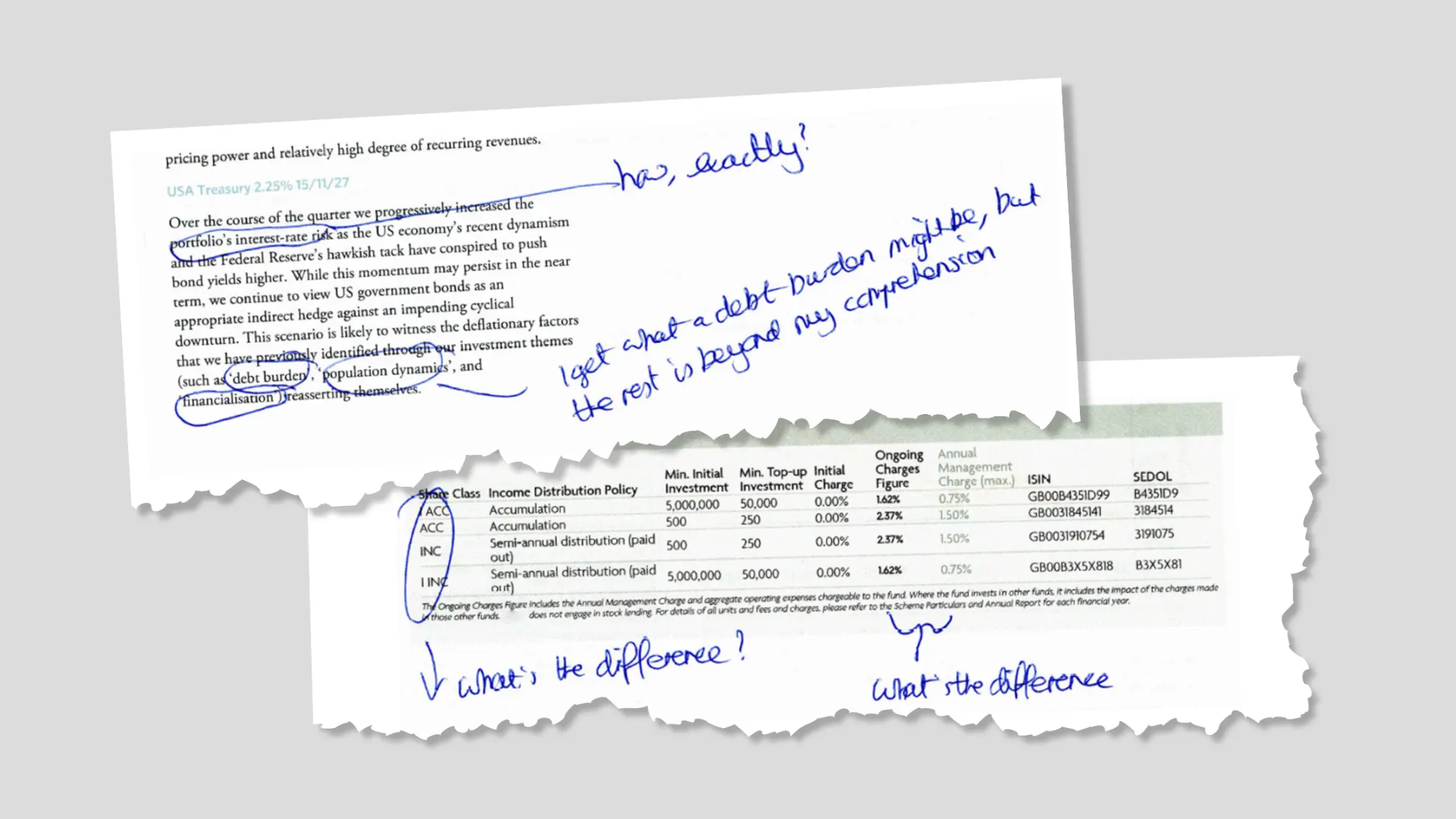

Communications testing to support Consumer Duty

Consumer duty requires firms to test their communications with customers, in order to ensure that consumers are able to: find information, comprehend the information, and that the information provided supports them to make good decisions that inform the right action for their investment objectives.

Boring Money’s qualitative research team has been working with the biggest firms in the investments sector to ensure that their documents contribute to the best outcomes for the end client.

Get in touch with us to buy the report

Please contact rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.