The Gender Investment Gap increases for second year in a row

By Boring Money

5 Mar, 2025

The Gender Investment Gap increases for second year in a row

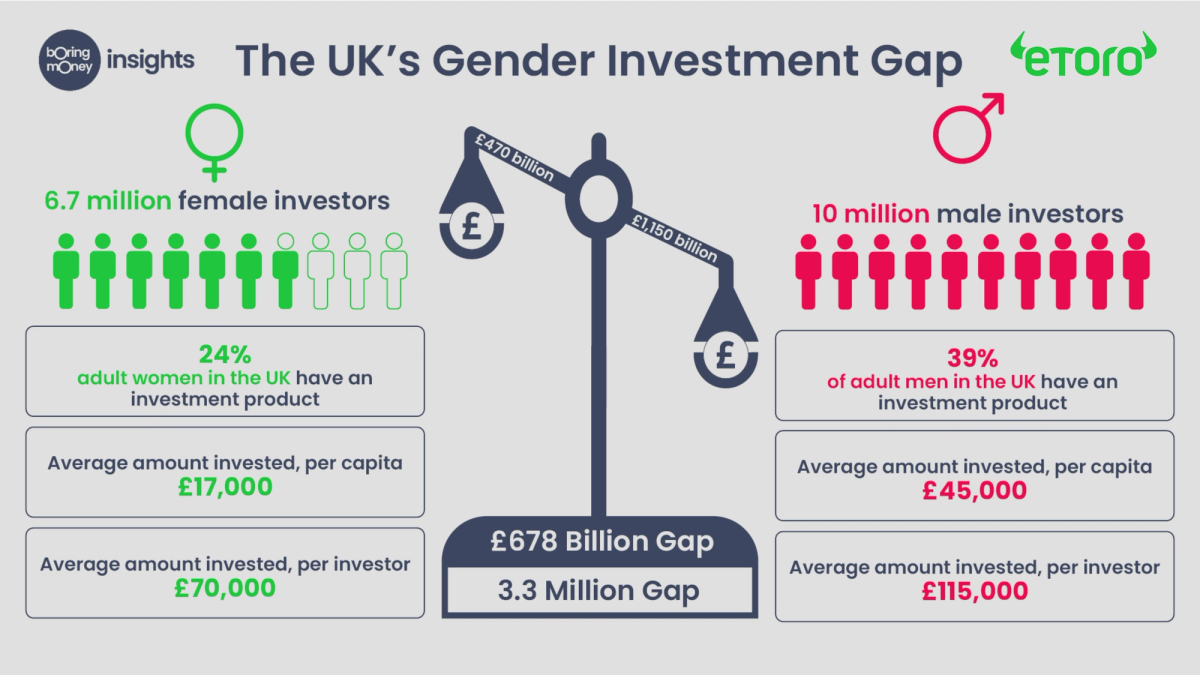

There are now 3.3 million more male investors in the UK – 6.7 million women invest compared to 10 million men. The gap widened by 200,000 people in the past 12 months.

The average amount invested, measured by those currently investing, is £70,000 for women and £115,000 for men.

A £1.2 billion increase means that the Gender Investment Gap rises to £678 billion in 2025, roughly the size of the GDP of Switzerland.

Young men are investing at double the rate of young women – 41% of men aged 18-34 invest vs 20% of women.

Conversations could close the gap in just 7 years.

Holly Mackay, CEO of Boring Money, comments, “The Gender Investment Gap just keeps on getting bigger, and men now own 71% of all invested assets in the UK. The gap is widening primarily because younger women are not taking up investing at the same rate as younger men.”

54% of new investors in the last 12 months are male, while 46% are female. However, the gap is accentuated by the fact that women have dropped out of investing at a faster rate than men in recent years.

Boring Money was brought in by eToro to support the launch their ‘Loud Investing’ campaign, providing market data and consumer insights. The goal is to promote honest discussions, dispel myths, and break down the barriers to investing. The campaign calls on women who invest to have one conversation about investing with a female friend, relative or colleague, sharing their experiences and inspiring others.

The gap among young people

Young men are more than twice as likely to invest as young women. 41% of men aged 18-34 invest versus just 20% of women, by far the highest gender discrepancy within an age group.

Lale Akoner, Global Market Analyst at trading and investing platform eToro, who partnered with Boring Money on the research, comments, “The explosion of retail investing among young people is helping millions build long-term wealth. But the opportunity is being taken disproportionately by men. This needs to change or the already vast gender investing gap will just get worse and worse.”

Closing the gap

eToro asked Boring Money to calculate how the power of conversation could help bridge the gap. The results show that if every existing female investor had a conversation with a female non-investor, and 10% of these converted them to investing each year, it would take just 9 years to close the gap. And if every existing investor (male or female) did so, the gap would be closed by 2032.

Akoner continued, “For us, the key is what we call ‘Loud Investing’ – real and honest discussions about investing that help break down the barriers holding women back. Today, 6.7 million women invest, meaning there are 6.7 million role models who can encourage other women to invest by sharing their own stories. The data shows that change is not only necessary but well within our grasp.”

Confidence and attitudes to risk

Mackay comments, “The key barriers to overcome are confidence and attitudes to risk. Just 20% of female investors agree that they are ‘comfortable taking on a lot of risk when it comes to their investments’ compared to 44% of male investors. In practice we can see that this translates to women having higher sums of money in cash than is perhaps appropriate for their life stage.”

Recent, separate research from eToro supports this. It found that, among British retail investors, women are more likely to select investments that deliver slow and steady returns. For example, female investors are much more likely than male investors to invest in UK bonds (44% vs 38%) and overseas bonds (24% vs 20%). By contrast, male investors are more likely to invest in equities, particularly for the US stock market, to which 41% of men’s portfolios are exposed, compared to 24% of women’s.

As part of the research, eToro asked investors the asset classes to which they would increase their allocation, should interest rates fall. Among women, cash was by far the most popular response (30% vs 22% among men). Conversely, the leading response for men was stocks in growth sectors (27% vs just 19% of women).