28% of advised customers today would prefer a fixed-cost one-off advice model

18 May, 2022

New research from Boring Money shows clear customer preference for more flexible advice models to suit a broad range of needs and preferences.

Boring Money CEO Holly Mackay comments, “We know that customers do not fit into the neat distribution channels that large firms like to place them in. Life is messy and so people have multiple accounts and have differing needs depending on what life throws at them in any one year.

Advised clients today remain broadly happy with the service they receive, although 3 in 10 say they would prefer to pay a fixed fee for advice as and when they needed specific help.”

1 in 5 advised customers today use a DIY investment account and 3 in 10 would prefer a different model, paying a fixed “£ fee” for specific advice, at a moment in time or at a given life event.

20% of advised clients also use a D2C platform.

28% of all advised customers today cite a preference for a needs-based one-off advice model, compared to 45% who prefer the ongoing holistic advice they get today.

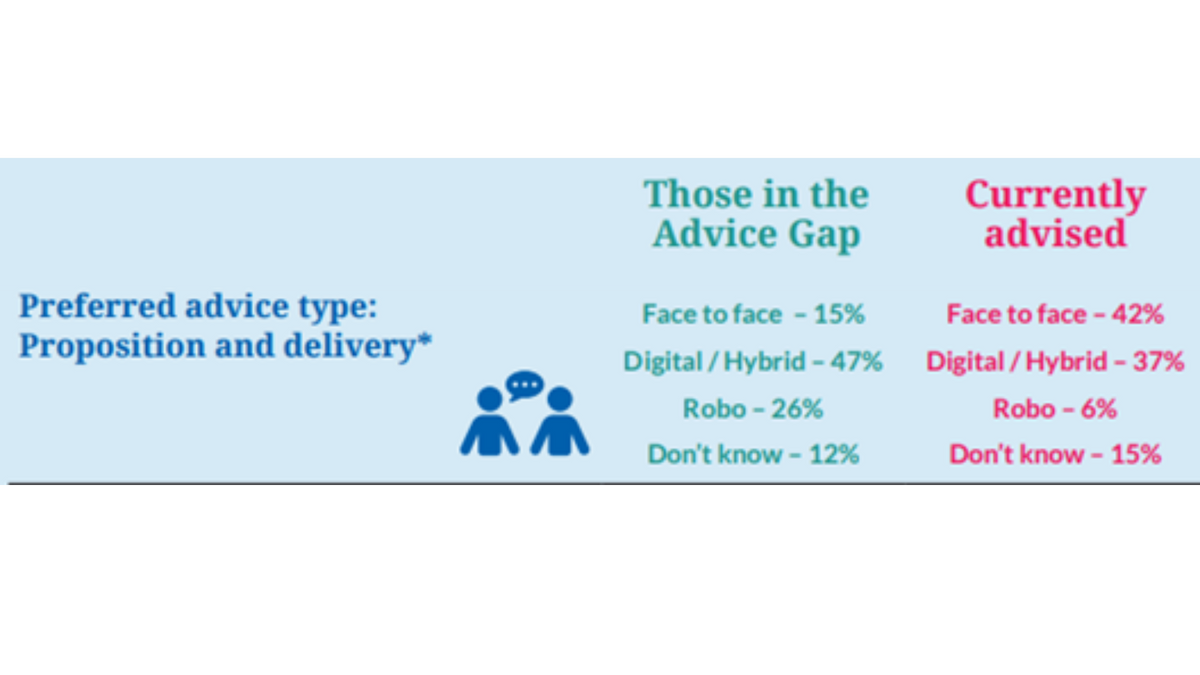

42% of advised customers today prefer a traditional face-to-face model, over a hybrid advice model.

Those who prefer face-to-face have average total assets of £147,000 compared to average assets of £86,000 for those who prefer the lower cost hybrid advice model.

The research also shows that the preferred model for those in the Advice Gap today – which Boring Money sizes at 13.2 million adults – is a digital/hybrid advice model.

Notes to editors:

1. Boring Money is an independent research and publishing house which provides information, tips and Best Buy tools to savers and investors. Currently, the website has over 200,000 monthly readers.

The business conducts regular research with industry providers and UK consumers to track the developing DIY investment market from both the customer and provider perspective. Boring Money holds test accounts with over 25 investment platform providers. It also holds regular focus groups and interviews with consumers to ensure regular input and feedback from the user perspective.

Founder Holly Mackay has worked in the investment industry for 20 years and is supported by a team of 28 researchers, analysts, technologists and marketing execs. Boring Money is not regulated to give personal financial advice nor is it regulated by the industry watchdog.

2. Sample size and dates of research:

An online survey of 6,305 nationally representative UK adults conducted in January 2022

An online survey of 3,126 nationally representative UK adults conducted in April 2022

Online survey of 71 financial advisers, conducted in April 2022

3. Definitions of digital advice and robo advice used in survey:

Digital advice

An adviser who will manage your finances for you, but there will be more work on your part. For example, filling out a questionnaire about your financial situation online and collating your own documents.

You will have an initial meeting on videocall or over the phone, but there will be less opportunity for regular communication with an adviser.

Medium cost.

Robo advice

You fill out a questionnaire online on subjects such as value of savings, spending habits and attitude to risk and receive recommendations based on your responses.

You will not be able to speak to an adviser directly.

Low cost.

Advice type: Proposition and delivery

Face-to-face:

An adviser who will manage your finances for you, and do all the legwork. There is little effort on your part.

You can contact your adviser easily throughout your relationship and meet face to face if preferred.

High cost.

Advice type: Scope and regulation

Holistic advice:

An adviser to review your financial situation as a whole, in order to offer a personalised recommendation on all areas of your finances.

High ongoing cost.

One-of /simplified advice:

Advice on one element of your finances, based on a partial review of your financial situation (example: how much you should be contributing to your pension, inheritance tax planning, etc).

Medium one-off cost.

Coaching

A financial coach to help you to understand your options in order to empower you to take control of your finances, however they cannot make specific product recommendations or manage your finances for you.

Low one-off cost.

Please contact:

Holly Mackay, CEO & Founder

07984 609 827

holly@boringmoney.co.uk

Mikhail Ismail, Head of Marketing

mikhail@boringmoney.co.uk