Retail Investor Analytics

Collaborating with global Fintech leader Broadridge Financial Solutions, Retail Investor Analytics provides asset managers with product analysis, data and direct feedback from retail investors to holistically address the requirements of the UK's Consumer Duty regulation and allows for the identification of potential areas for improvement.

What is Retail Investor Analytics?

Retail Investor Analytics provides Asset Managers direct feedback and data from retail investors and allows for the identification of potential areas for improvement required under Consumer Duty.

This assists asset managers to:

1. Evidence compliance in line with Consumer Duty regulatory requirements – evidencing you are providing a good outcome for retail customers

The next slide shows how the report will support firms to evidence and understand their obligations to Consumer Duty

2. Evidence the distribution of funds with retail customers – to support internal proposition, marketing, and strategy teams and Board packs

The report is also used by product and distribution teams to support post-sale reviews and retail product & pricing strategy

Using syndicated data from both Broadridge and Boring Money, this cost-effective method uses competitor benchmarking data to further evidence your brand’s position amongst your peers in your competitor landscape with both actionable insights and solutions.

How does this support asset managers?

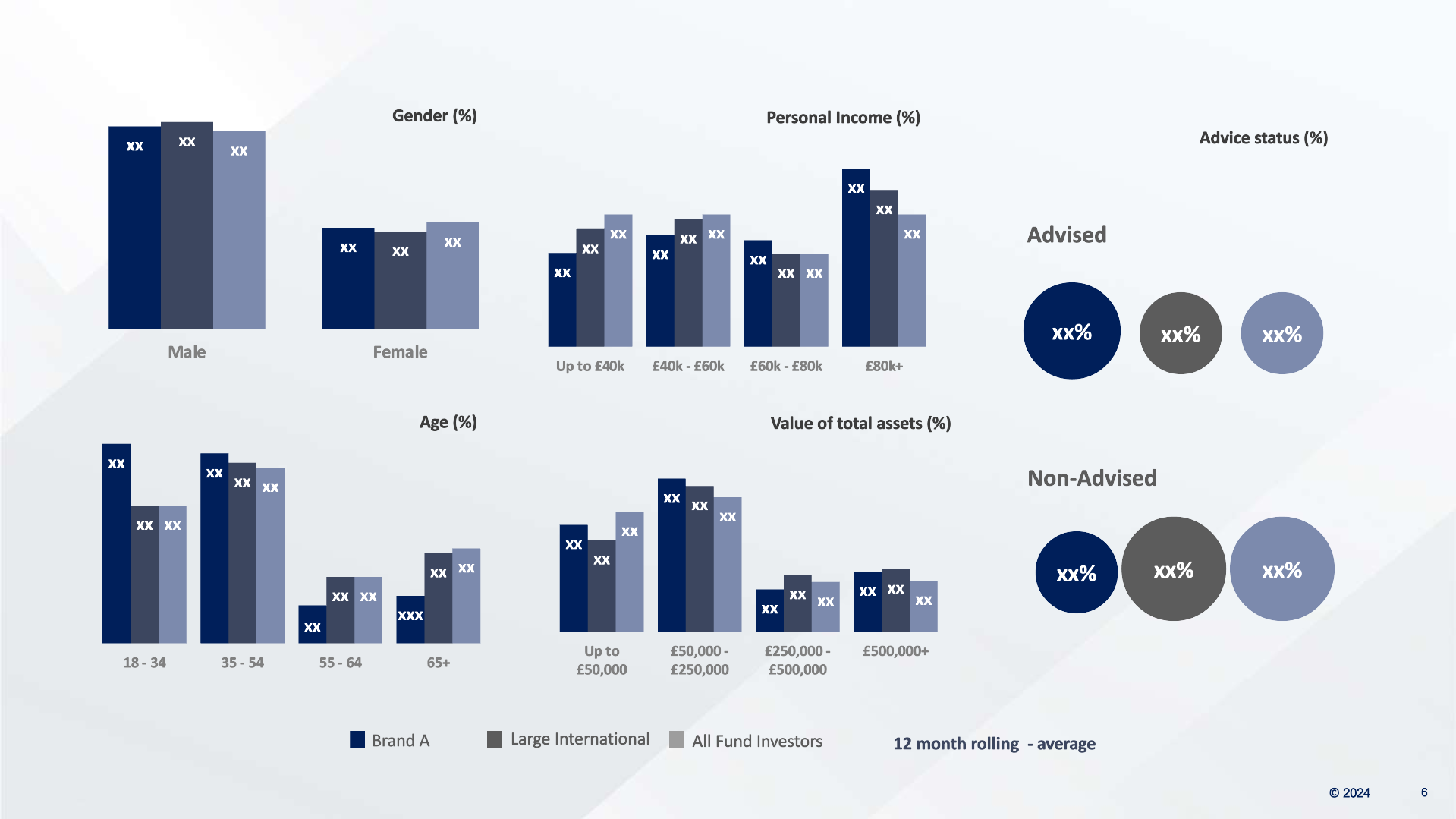

Retail Investor Understanding - Build a data-led picture of your retail investors' demographics, wealth, confidence, capacity for loss, average advised status etc. as required under Consumer Duty Regulations

Perception Gaps Identification - Compare quantitative performance with qualitative investor feedback & perceptions to identify gaps and opportunities in marketing, support & understanding

Benchmarking - Compare your investors' value perceptions vs. industry and peers. See trends from 2019 across major retail brands and quality of service metrics

Competitive dynamics - Comprehend characteristics of why certain brands are winning or losing business

Cost effective - Conduct a bi-annual pulse check of retail investors costs effectively to evidence your brand’s position in your landscape with both actionable insights and solutions

Funds Suitability - Obtain insights on suitability of your fund range by understanding the objectives and risk tolerance of your fundholders

Evidence Value - Evidence and illustrate retail investor data to support the requirements under Consumer Duty outcomes

Vulnerable Customers - Identify and evidence areas where investors need additional support and frame a proportionate approach

Supporting Consumer Duty Compliance

The Consumer Duty regulation requires all manufacturers and distributors to prioritise their customers' needs and deliver a good outcome for retail investors, emphasising fair value, suitable products, adequate support, clear communications and avoid foreseeable harm (Jul 2023).

Retail Investor Analytics provides evidence for the required outcomes for Consumer Duty reporting in the following aspects:

• Price & value - customer perceptions of overall value, pricing, performance; risk management review; competitor benchmarking; data on fund performance by class, costs disclosure, risk-adjusted return metrics, and brand trust.

• Products & services suitability - data on product & services suitability across product lifecycle; competitor benchmarking; target market; suitability assessment (demographics, wealth); risk tolerance; fincial goals; product retention/trust in brand; distribution channel suitability; advised/non-advised; sustainability consideration

• Consumer Understanding - clarity/transparency review; communications effectiveness review; customer demographics; platform usage; financial goals/outcomes; risks tolerance; advised/non-advised; brand awareness; sustainability considerations

• Consumer Support - data on quality of service; competitor benchmarking; brand perception; trust in brand review; overall customer rating of brand

• Vulnerable Customers - data on investor vulnerability; identification of vulnerable customers; vulnerability impact review; risk tolerance

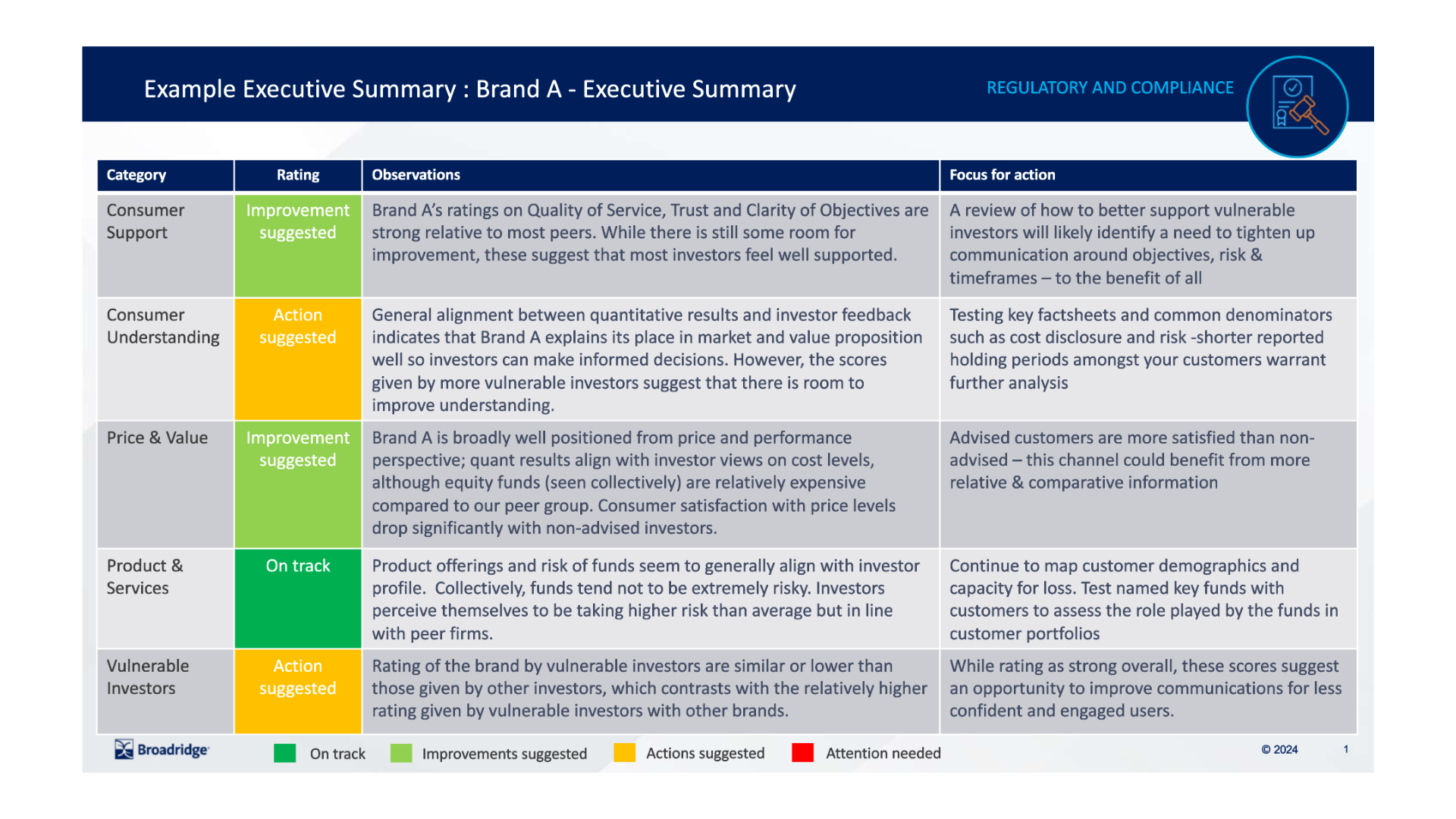

Indicative report contents: Consumer Duty - Executive summary of actions

Within the Retail Investor Analytics reports we include an Executive Summary page of areas where further review or investigation may be warranted (based on our interpretation of the data) in line with Consumer Duty outcomes. We believe the data on investor perceptions and quantitative fund rankings will help identify areas where review is required to support the Consumer Duty process.

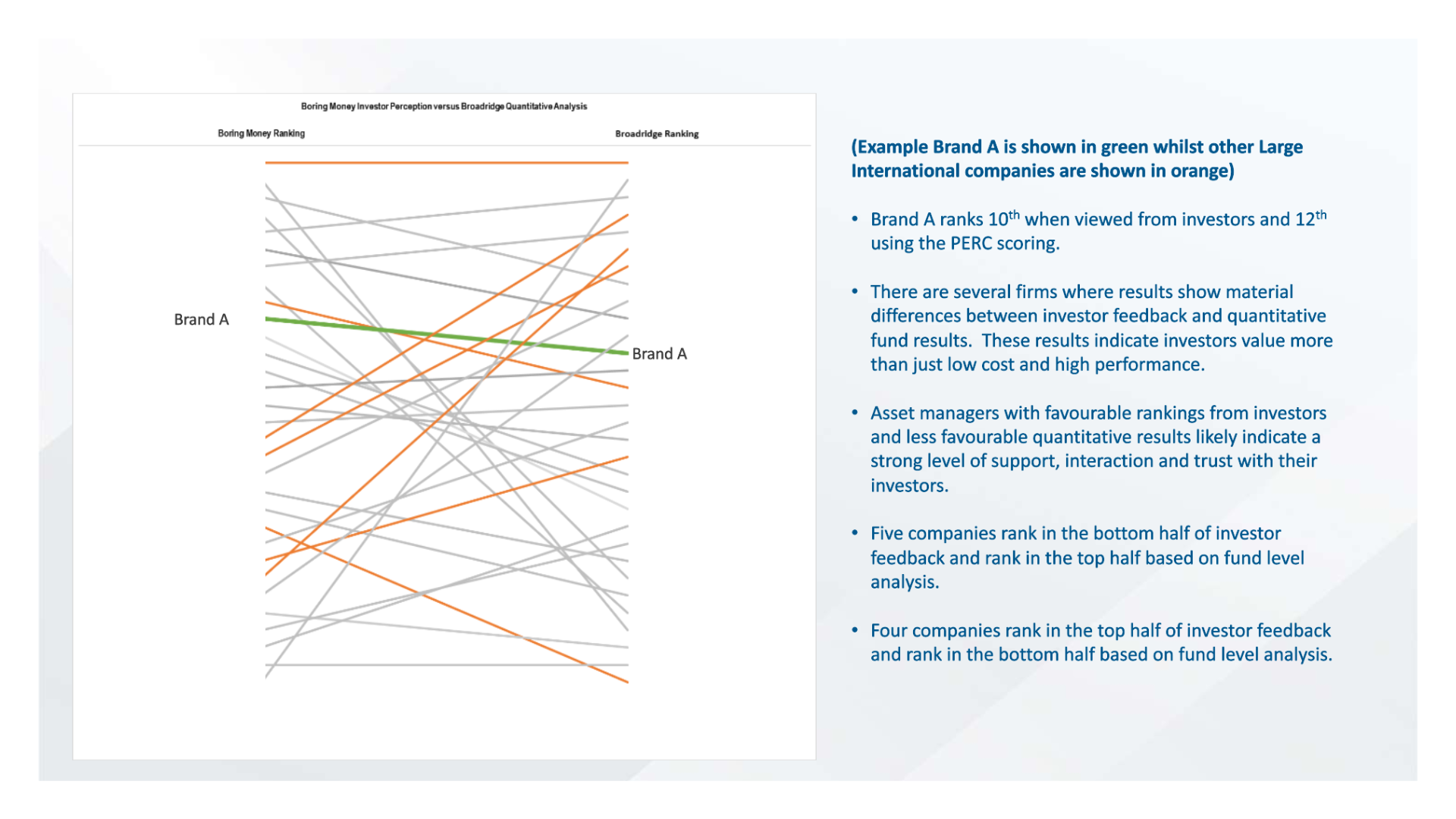

Indicative Report Contents: Value Rankings

Boring Money Investor Perception versus Broadridge Quantitative Analysis

Through the amalgamation of Boring Money and Broadridge data, we are able to identify misalignments between customer perceptions of brand value and the reality of brand value (using a score combining quantitative data on Performance, Expense, Risk and Consistency). This misalignment of data may indicate a Customer Understanding gap or a challenge with Products & Services and the target market.

Indicative Report Contents: Retail Consumer Understanding

Insights on your end retail consumer to demonstrate understanding and awareness - compared to the industry and your competitors

Indicative Report Contents: Cost of Funds

Using Broadridge quantitative cost evaluation data our Retail Investor Analytics report is able to compare your brand to both your immediate peer group and the wider universe of firms tracked by Boring Money. This intends to provide macro-level insights into costs and what types of products may be driving investor perceptions.

Why choose us?

Trusted Partner

Leading provider of independent Consumer Duty data to 250+ international fund boards

Full Service

End-to-end service combining Retail Investor Analytics, independent benchmarking & distributor data

Regulatory Capability

30+ years of US, UK, EU regulatory experience with direct access to regulators

Frequency and Quality

Semi-annual actionable insights report delivered by an experienced implementation team

Indicative pricing

• Pricing is dependent on scope - we are very happy to discuss this on a case by case basis and what deliverables are required

• There is an option to add-on Retail Investor Focus - additional in-depth qualitative research with circa 50 of your brand's retail customers (reached via Boring Money's panel of UK investors) regarding fund ownership, fund tenure, evidencing product suitability, etc. We are very happy to discuss this in addition to our standard Retail Investor Analytics package

• The standard Retail Investor Analytics package includes 2 x reports per annum, delivered every 6 months

• Minimum subscription of 1 year

Get in touch for more information on Retail Investor Analytics

Please contact rachel@boringmoney.co.uk to discuss how we can support asset managers with Consumer Duty.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.