Platform Investor Tracker

Our Platform Investor Tracker is a syndicated survey for DIY investment platforms created in response to Consumer Duty and internal reporting needs.

Every six months, we collect data from 3,000+ DIY platform investors (who have to hold either an ISA, GIA or SIPP) using an online quantitative survey. We can supply platforms with independent metrics on what your customers value and also benchmark platforms against peers. Data can be segmented into product wrappers held, and demographic groups and life stage.

Overview

What is included?

Historic Data Tracking - Boring Money has been tracking what retail investors think about platforms since 2022

Benchmarking against peers - Our bi-annual data assesses 10 key areas of service across your platform, whilst benchmarking against your peers

Market comparison - We track 26 DIY investment services but also group providers into peer groups for more relevant analysis

Deliverables - Our clients receive a detailed report every 6 months alongside an analyst presentation

Key metrics - The report includes NPS, metrics for 10 key drivers of value, input for Consumer Duty reporting and a special Consumer Duty summary with supporting evidence

Relevance - The report is used to support marketing, proposition and executive teams, alongside supporting Consumer Duty reporting

Consumer Duty

The Consumer Duty final guidance came out on the 27th July 2022, outlining how DIY investment platforms need to evidence their understanding of their customers in relation to these four outcomes:

Products and services

Price and value

Consumer understanding

Support

Platform Investor Tracker was created in response to Consumer Duty to assist brands in line with these requirements using data demonstrating customer understanding and perceptions for both your brand and benchmarking these scores against your peers.

What the survey covers

What do you get from this?

Independently sourced customer data on how you are seen to be delivering value to your customers

Permission to use and cite this data externally, in client and investor reporting

Benchmarking against key competitors

Metrics on various aspects of value including price

A scorecard covering key value KPIs

Data tables covering detailed metrics

Key recommendations on areas for action

Ongoing tracking

Benchmarking data - a snapshot

Our charts and data benchmark your brand against competitors in your immediate peer group and all other DIY investment providers that we track. These insights can support with:

• Bi-annual insights to inform your board

• Essential market data and trends

• Committee reporting

• Up to date data on consumer sentiment, buying intention, and what your customers think

• Assistance to gauge how you compare to leading competitors

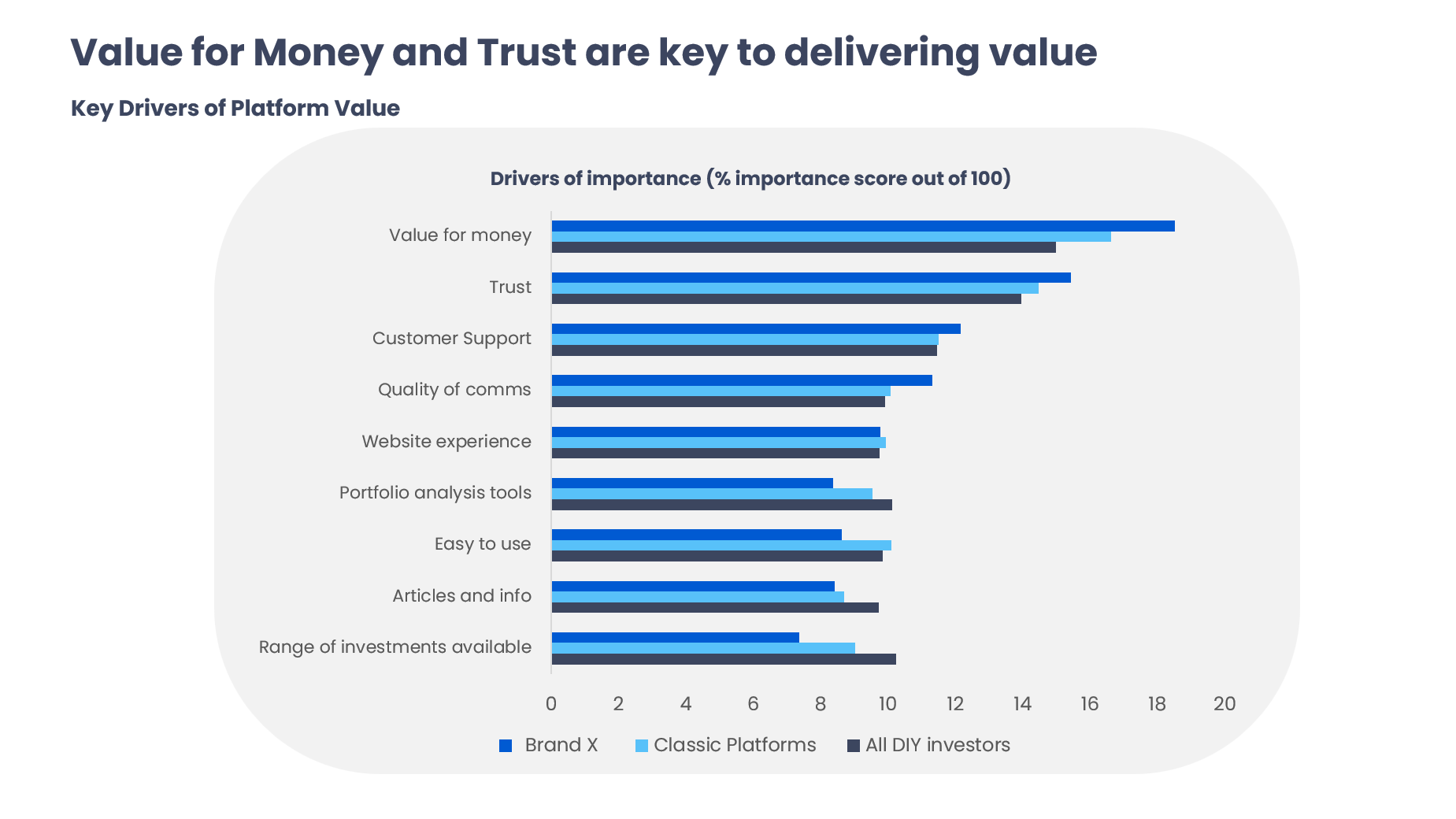

Value for Money and Trust are key to delivering overall value for customers

Although value breaks down into many component parts, we know that value for money and trust are fundamental for customers and their experience and perception of a brand (based upon recommendation/NPS and overall satisfaction scores). In general, the less confident the investor, the more trust they put in larger brands.

Within the Platform Investor Tracker reports, we demonstrate what your customers value the most, benchmarked against both customers of your immediate peers and customers of all the DIY investment platforms that we track.

Deliverables and outcomes

Every 6 months, platforms would receive a circa 20 page report of results, in PowerPoint/PDF format - this will include:

• Profile of your customers, and how they compare to Platform Investors as a whole

• KPIs, including NPS, and benchmarking against key competitors

• Metrics on various aspects of value, including price

• Customer verbatims of their views on the brand and a summary of key themes that emerge from the feedback

• Ongoing tracking and identification of successes and pain points over time

• 1 page summary of recommendations for actions to align with Consumer Duty outcomes

Clients are licensed to use data both internally and externally for reporting and marketing purposes.

Clients have used this for their ExCo, Board reports, Investor Relations, compliance teams (Consumer Duty) and marketing and proposition teams.

Pricing

The reports & data cost £24,045 + VAT per annum (to include 2 x waves)

Each wave is delivered in January and July

Each bi-annual report is customised to showcase your data against the market and against banking peers for specific attributes

You are licensed to use your data both internally and externally for reporting and marketing purposes

Minimum subscription of 1 year

Get the full Platform Investment Tracker report

Please contact rachel@boringmoney.co.uk for more information or to request a call with the research team.

Our top picks

Explore more of our products to gain valuable insights and learn how we can help your strategy and propositions through our services.