Consumer Duty: I'm a Platform

Supporting investment platforms with external input, metrics, validation and customer testing.

We have worked with Platforms

Boring Money is helping advice firms, platforms, and asset managers to plan and create better customer outcomes. With over 6 years’ experience in understanding and tabling the customer voice, we can help with data and insights on both consumers in general and your more specific customer base.

Every 6 months we conduct extensive research with 3,000 platform cohorts, as well as our broader nationally representative surveys.

We have worked with Platforms

Boring Money is helping advice firms, platforms, and asset managers to plan and create better customer outcomes. With over 6 years’ experience in understanding and tabling the customer voice, we can help with data and insights on both consumers in general and your more specific customer base.

Every 6 months we conduct extensive research with 3,000 platform cohorts, as well as our broader nationally representative surveys.

1. Test client communications against Consumer Duty

Under Consumer Duty, firms must evaluate their communications with end clients or their target market to ensure consumers can locate information, understand it clearly, and use it to make informed decisions that align with their investment goals.

We have significant experience in helping clients assess whether their communications promote positive outcomes. Our team has tested hundreds of client-facing materials, such as investment documents, brochures, web pages, and customer journeys.

Comms Testing to assess against Consumer Duty

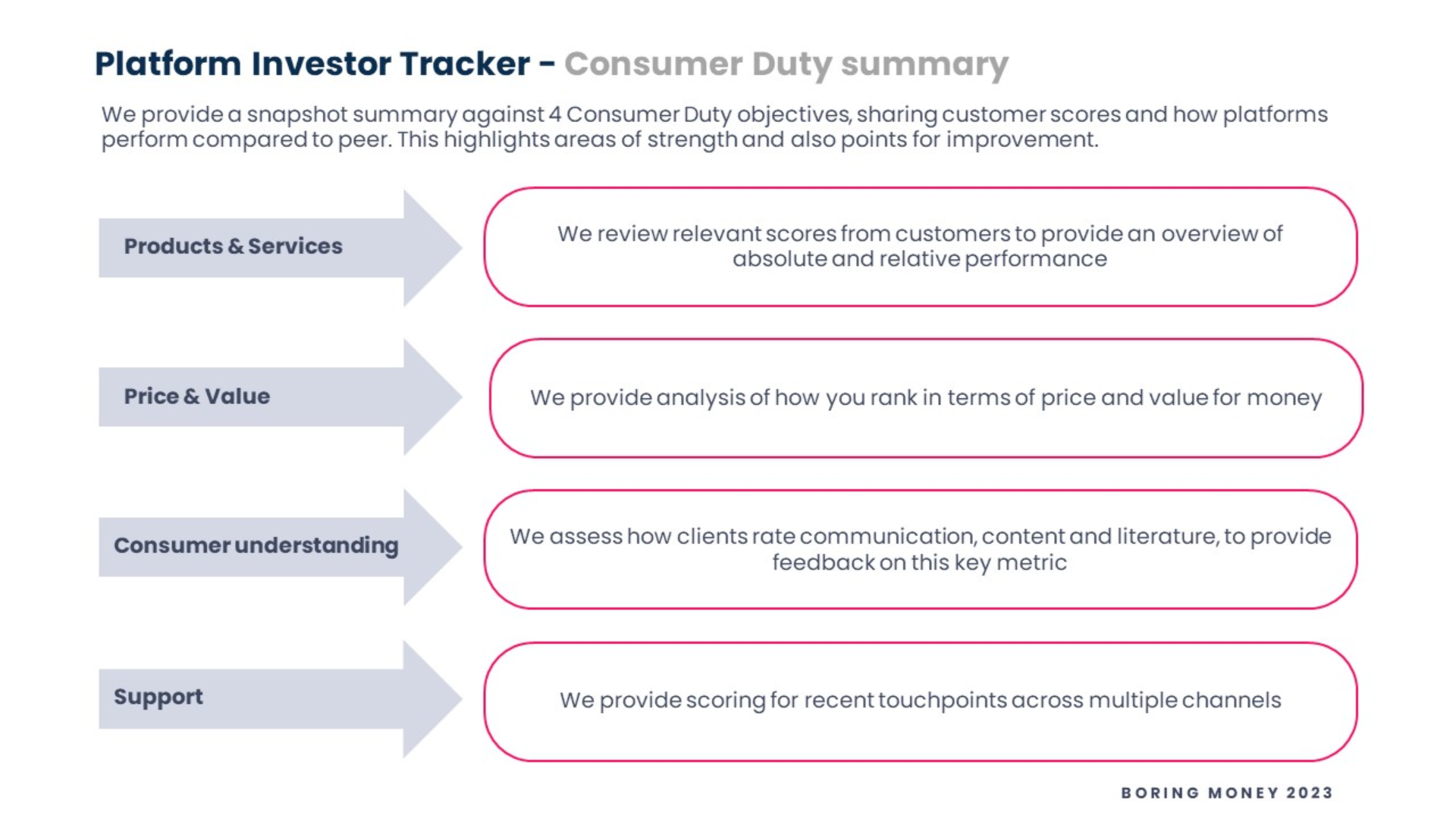

2. Evidence value, and benchmark against your competitors

We have experience tracking and benchmark value for asset managers since 2019. We’ve now turned our expertise to tracking Value for Platforms, to support firms with Consumer Duty. We speak to 3,000 fund investors every 6 months, collecting and reporting back ratings for 28 of the largest UK investment platforms.

Talk to us about our Platform Investor Tracker.

3. Client segmentation and bespoke research

We survey 12,000 investors, and an additional 13,000 nationally representative UK adults every year. We can use our existing data to identify and size opportunity segments for your brand, providing quick, reliable input into documenting and understanding your target market.

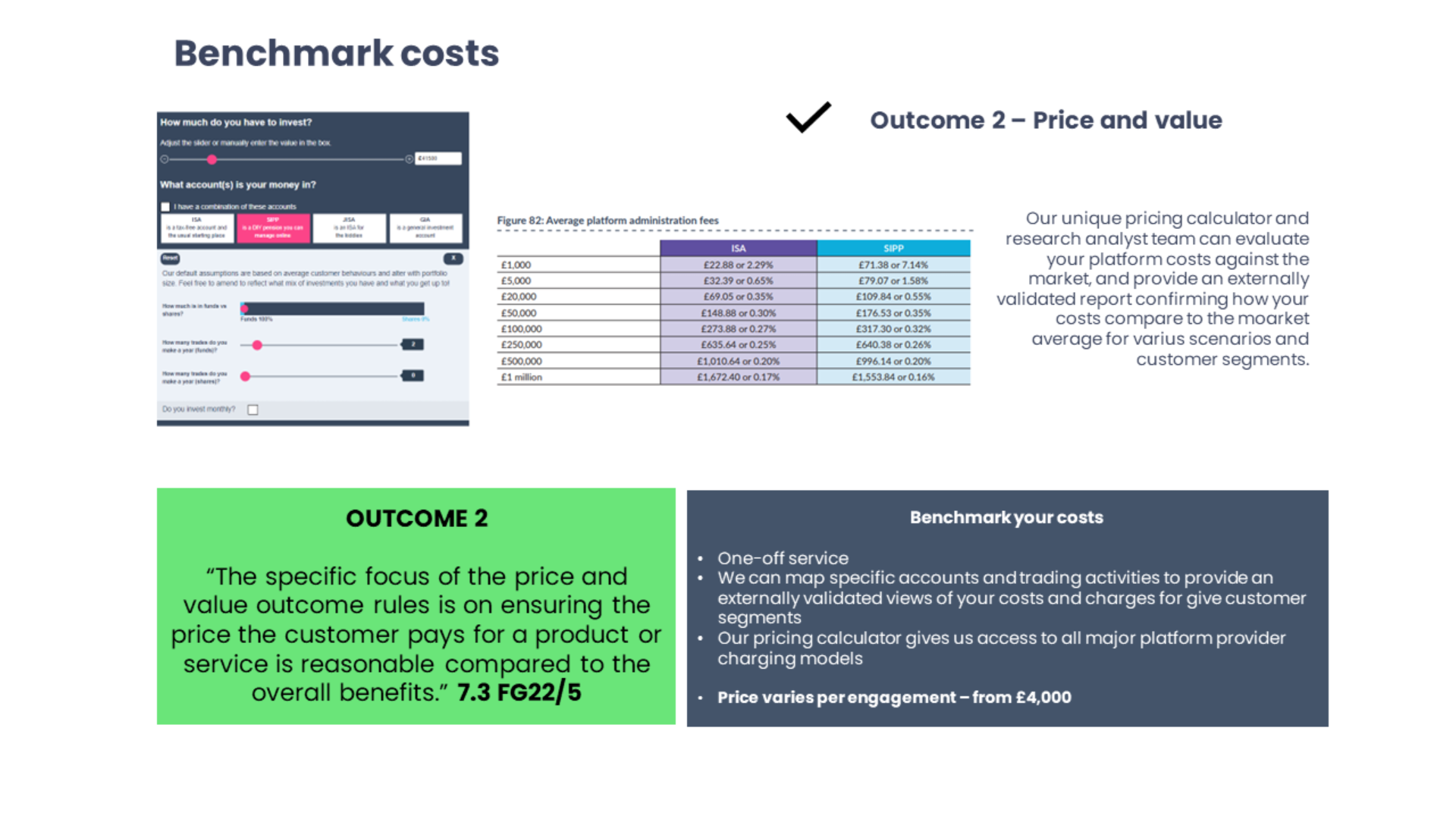

4. Ensure a reasonable relationship between price, benefits and value

We can provide an independent benchmark of your costs against industry average and map both a consumer and our independent view of the benefits. How do the costs and benefits come together to represent value?

5. Client communities

Client communities can be an effective way to put the customer at the heart of your business, in line with the principles of Consumer Duty. This involves recruiting your end clients to an ‘always on’ panel. Clients use these to run communication testing, ad hoc research to get client opinions on various topics, product propositions or content pieces, and taking a pulse of your clients.

Ensure a reasonable relationship between price, benefits and value

We can provide an independent benchmark of your costs against industry average and map both a consumer and our independent view of the benefits. How do the costs and benefits come together to represent value?

Understand your target market

What do your customers prioritise and value?

Are your products the right fit for your target market?

What do good outcomes look like for your audience?

How are you looking after vulnerable customers?

Need to work out your plan for Consumer Duty?

Download our deck to see how we are working with platforms today, or contact our Research Team with a specific request.