Consumer Duty: I'm an Advice Firm

Supporting advice firms with external input, metrics, validation and customer testing.

Boring Money is helping advice firms, platforms, and asset managers to plan and create better customer outcomes. With over 5 years’ experience in understanding and tabling the customer voice, we can help with data and insights on both consumers in general and your more specific customer base.

Need help responding to the new Consumer Duty?

Here are 4 ways we can support:

1. Test and refine your client communications with your target market

Consumer Duty mandates that firms evaluate their communications with end clients or their target audience to verify that consumers can access information easily, understand it fully, and use it to make informed decisions aligned with their investment objectives.

Our team has extensive experience in assisting clients to review their communications for positive outcomes. We have conducted testing on hundreds of client-facing materials, including investment documents, brochures, web pages, and user journeys.

Document Testing in reaction to Consumer Duty

2. Define value with independent input

In response to Consumer Duty, Boring Money has created a framework that provides a structured approach to assessing the value advisers provide using the real experiences of clients. Our Advice Value Framework report, identifies the key drivers of value for advice clients, and provides practical guidance on how to implement the framework within your organisation.

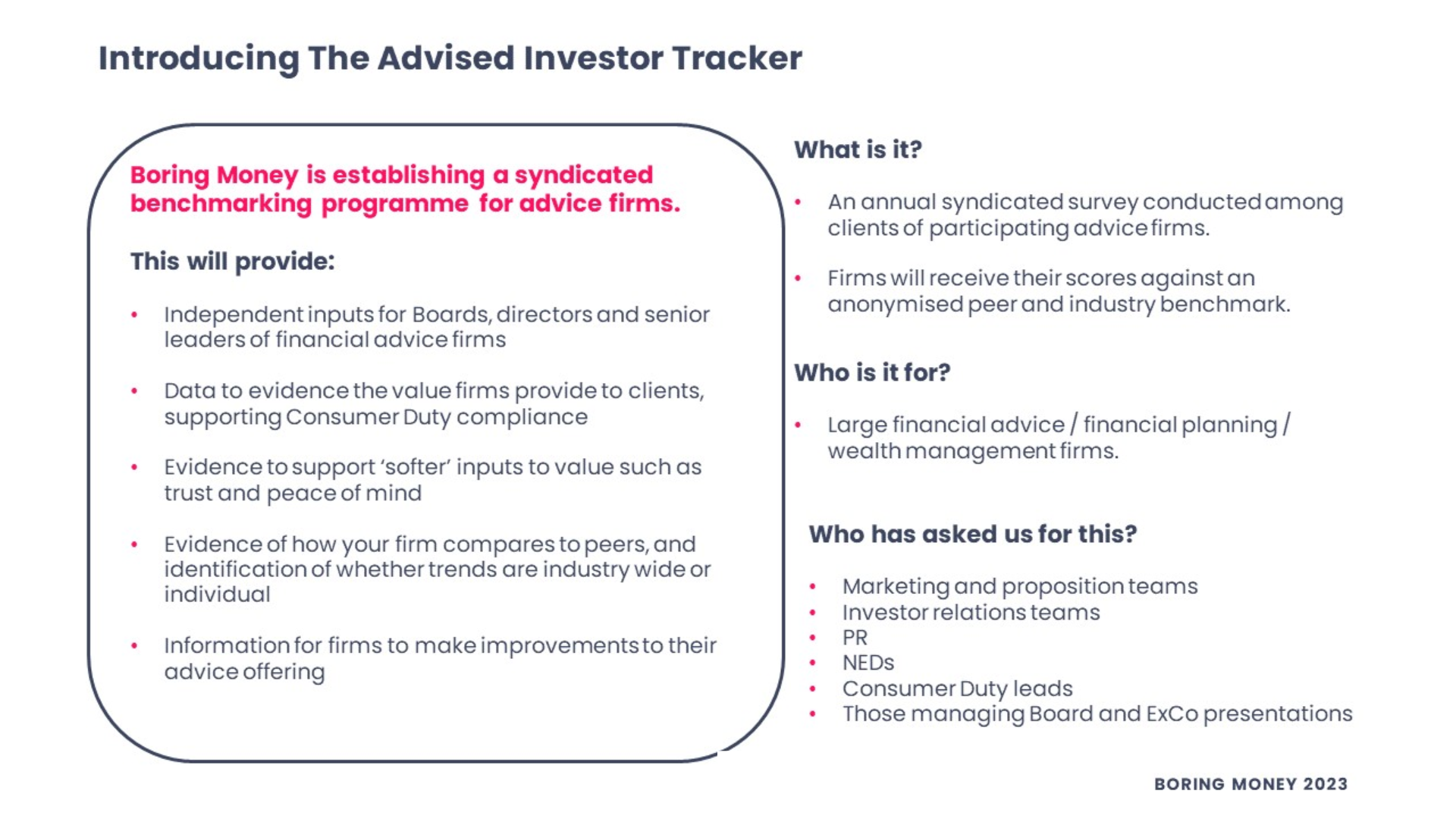

3. Measure the value you provide to clients and benchmark this against competitors

We have experience tracking and benchmark value for asset managers since 2019. We’ve now turned our expertise to tracking Value for Advice firms, to support firms with Consumer Duty. In 2023 we developed a framework to measure value for advice clients, that goes beyond just the fee/performance relationship. We now use our syndicated tracker to help advice firms measure the value they are providing, and to benchmark themselves against peers.

4. Identify your target market, understand their needs, characteristics and objectives of your target market

We survey to 12,000 investors, and an additional 13,000 nationally representative UK adults every year. We can use our existing data to identify your target market and to understand their needs, characteristics and objectives, providing quick, reliable input into documenting and understanding your target market.

5. Client communities

Establishing client communities is an effective way to prioritize your customers and align with Consumer Duty principles. This strategy involves setting up an ‘always-on’ panel of clients. Companies use these panels to test communications, conduct ad hoc research for client insights, evaluate product propositions and content, and monitor client sentiment.

Need to work out your plan for Consumer Duty?

Download our deck to see how we are working with advice firms today, or contact our Research Team with a specific request.